Complete our online application form in less than 5 minutes. Include basic details such as your name, date of birth, address, employment status and the amount you wish to borrow.

Apply for Payday Advance Loans in Minnesota MN with Dollar Hand

We can help you get payday loans in Minnesota. Get up to $350 in the palm of your hands today!

How To Get Payday Loans In Minnesota

Step 1 - Apply Online Today

Step 2 - Receive A Loan Offer

We will search through our database and match you to the lender most suited to your borrowing requirements. An instant loan offer will appear on your screen for you to review.

Step 3 - Payday Loan Transferred To You

If your application is successful, the funds will be transferred to your bank account within hours or by the next business day latest. Better yet, the total loan amount will be sent in one lump sum.

What Should I Know About Minnesota Payday Loans?

Payday loans in Minnesota offer a fast and easy way to borrow money quickly. Whether you need to pay for an important expense, an emergency cost or an unforeseen bill that you have not budgeted for, these short term loans offer temporary financial relief to help you stay financially afloat until your next payday.

Borrowers in Minnesota are allowed to apply for as many loans as they may need, with no legal limitations. However, it is encouraged to only borrow a payday loan if it is really necessary. Payday loans should NOT be used on frivolous spending such as partying, shopping, drinking or gambling.

Where Can I Get A Payday Loan in Minnesota?

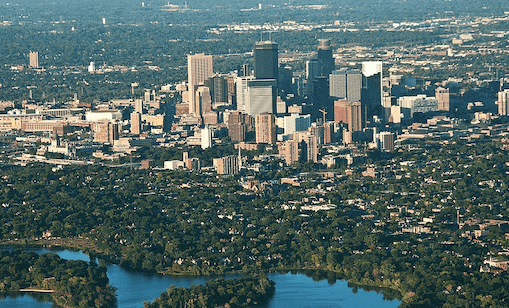

Dollar Hand’s loan platform is 100% online which means that you borrow money from anywhere across Minnesota and the US. All you need is a smartphone, tablet, laptop or computer to apply. See below for some examples of locations you can get payday loans in:

Minneapolis, Saint Paul, Rochester, Bloomington, Duluth, Brooklyn Park, Plymouth, Woodbury, Lakeville, Blaine, Maple Grove, St. Cloud, Eagan and Burnsville.

What Are The Minnesota Payday Loan Laws?

| Are Payday Loans Legal in Minnesota? | Yes |

| Maximum Loan Amount | $350 |

| Minimum Loan Term | Not specified |

| Maximum Loan Term | 30 days |

| Interest Rate (APR) | 200% |

| No. of Rollovers Allowed | 0 |

| Database Loan Tracking | No |

| Finance Charges | $5.50 for loans up to $50, 10% + $5 for loans from $50 to $100, 7% (min. $10) + $5 for loans from $100 to $250, 6% (min. $17.50) + $5 for loans from $250 to $350 |

| Statute of Limitations | 6 years from the last payment |

Do I Qualify For Online Payday Loans In Minnesota?

The eligibility criteria for online payday loans Minnesota is that you must:

- 1. Be at least 18 years of age

- 2. Be a U.S. resident

- 3. Have a live checking account

- 4. Earn a reliable income

- 5. Earn $800 each month

Can I Get Instant Payday Loans In Minnesota?

At Dollar Hand, we will endeavour to get you the funds that you need as fast as possible. After completing our quick and easy application form, you will receive an instant loan offer from one of our lending partners. If you decide to go ahead and your loan request is approved, the funds will be sent to your bank account within seconds, minutes or hours.

To boost your chances of a speedy loan in Minnesota, try applying during typical working hour of 9am to 5pm on Monday to Friday. We also recommend keeping your phone nearby incase the lender wants to get in touch with any follow-up questions.

FAQs About Payday Loans in Minnesota

Is Dollar Hand A Direct Lender?

No, Dollar Hand is a broker with access to a network of over 50 reputable direct lenders which means we are able to find the most suitable loan for you. We connect applicants with the lender who can meet their borrowing requirements. Better yet, our service is free of charge and always will be!

Can You Get Bad Credit Payday Loans Online In Minnesota?

Our lenders are willing to consider applicants with poor credit scores. They can focus on other criteria such as whether you earn a stable income, or can offer you alternative products such as secured loans.

Can You Do Early Repayments?

There is usually the option to make early repayments which can help you to save money on interest. You can check your loan contract or get in touch with the lender to confirm if this may be possible. You should also double check if there will be any early repayment penalty fees for doing so.

What Are Alternatives To Payday Loans?

Alternatives to payday loans including borrowing money from family or friends, using emergency savings or requesting an authorized overdraft from the bank. You could also consider signing up for a low interest credit card or looking into personal loans.

Are There No Credit Check Options?

Credit checks may be carried out. However, our lenders can focus on other criteria such as if you earn around $800 a month or have a live checking account for the funds to be deposited into.