Yes, you can stop a payday lender from taking automatic payments from your bank account. Provided that you write a letter to your lender, and bank or credit union in a certified format, then automatic payments should come to a standstill.

Payday lenders in the US use ACH Authorization to automatically collect repayments from their borrower’s each month on a date that has been confirmed in the loan agreement. It is an extremely convenient and legal system which is practical for both the lender and borrower alike as the automatic process means there are no manual tasks required on either side – payday lenders do not need to request the money from their hundreds or thousands of customers and borrowers do not need to spend time calling up the payday loan company, sending a cheque or going to the bank.

Automated withdrawals is the typical method used for paying back loans such as installment loans and mortgages. Whilst the recurring payments are similar to a standing order or direct debit, ACH Authorization is different in the sense that it cannot be stopped on the customer’s end and has to be canceled via the lender or bank.

99% of borrowers will have no issue with regular payments being taken by the lender. However, there can be times when customers may wish to stop automatic payments from leaving their bank account, and this guide explains how to do so.

How Do I Stop a Payday Loan Company From Taking Money Out of My Account?

There are several ways to legally stop a payday loan company from debiting money out of your account. This includes:

- Sending a Formally Certified Letter to the Payday Lender to Revoke Authorisation

You can send a certified letter to the payday lender to tell them that you are taking away your permission for the company to withdraw automatic repayments from your bank account. This will be legally binding and something that the lender has to adhere to by law. It should confirm a stop on your bank account.

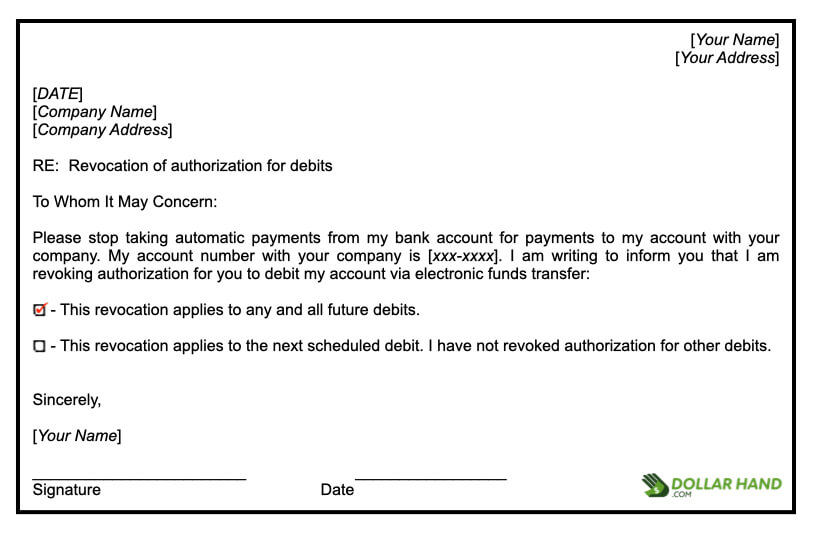

You can use the sample letter below for guidance, adding in your information and selecting the option which applies to your current situation:

We recommend keeping a copy of the mailed letter for your records, as well as calling the company to make the same canceling request by phone.

- Sending a Formally Certified Letter to Your Bank or Credit Union

Whether you bank with a US bank or credit union, you must also ask for the termination of automatic payments on their end too. Writing a certified letter, like the one mentioned above, will solidify that the payday lender no longer has permission to automatically take payments from your account, effectively revoking the ACH authorization.

- Submitting a Stop Payment Order to Your Bank

You can contact your bank via telephone, e-mail or letter to request a stop on an upcoming payday loan payment, providing that it is 3 days before the intended scheduled repayment.

- Clearing Your Whole Loan

One way to stop payday loans companies from automatically taking money from your account is by paying the whole loan off. Once the debt has been paid, the payday lender will no longer need to take payments from you. If you want to stop payments because you are worried that you are being overcharged, then this is a different situation and you should complain to the OLA or SEC.

- Organizing Debt Settlement

If you are struggling financially, then, you may want to consider debt settlement or debt management. This involves a structured program which helps you settle all of your debts. In this case, your debt settlement provider would organize the termination of automatic payments and send a small figure to the payday loan company each month, even if it’s just $10, until you are eventually debt-free.

Why Might I Want To Stop A Payday Lender From Taking Automatic Payments From My Bank Account?

Whilst it is the norm for payday lenders to automatically take repayments from your bank account, similar to a mobile phone contract or a mortgage loan agreement, there may be unexpected circumstances which means you want the pressures of automatic withdrawals to stop. Perhaps you do not have enough money to repay the loan yet or are low on funds and need money now for more pressing debts or necessities.

It is also possible, although unlikely due to strong regulations in the US, that you might feel that the figures are incorrect and the lender is overcharging you. If you do not trust the lender, you may want to stop collections immediately.

What Happens If I Stop a Payday Lender From Taking Automatic Payments From My Bank Account?

It’s important to remember that whilst you can stop automatic payments, the debt will still be outstanding. You will still need to repay back your payday loan and alongside regular interest may incur late fees for missing the repayment that would have been agreed upon in your loan agreement. It could also lead to a negative impact to your credit score, as you would be perceived as a less reliable borrower.

It’s important to give notice to the lender, especially if you have a valid reason why you need to block the payment, for instance due to a more urgent expense such as a health bill or loans for funeral expenses. Raising the issue with the lender may lead them to organize an alternative more flexible repayment plan or they may temporarily freeze your account and restart it when you are in a stronger financial position to resume automatic payments. Not communicating with the lender is only going to incur you more fees and cause additional stress.

Can I Just Cancel My Whole Payday Loan to Prevent Automatic Payments From Leaving My Bank Account?

Yes, there is usually a clause in the terms and conditions of your payday loan agreement which gives you the option to cancel your whole payday loan within 24 or 48 hours of taking it out. This would be without any fees or only one day’s work of fees which is manageable.

If you are hoping to terminate your payday loan at a later stage of your lending period, then you might have to pay the interest that was accrued up until that date. For instance, if the loan had been open for 18 days so far, you would pay 18 days worth of interest. Usually however if you wish to cancel a loan, you will have to pay the debt off in full.

Was this article helpful?

Justine is a full-time writer with lots of expertise and a wealth of experience in the financial world. In particular, she specializes in household income and consumer finance across the United States. Follow her articles for useful advice and top tips, guides on how to save money and lots more.