Payday loans are legal in 37 states, and illegal in 13 states. The biggest states for payday loans are California, Nevada, and Texas. Colorado, Montana, New Hampshire, and South Dakota have all set caps on payday loan interest rates.

Payday loans are a way to get extra money before your payday. They can be extremely beneficial if you encounter a financial emergency or incur unexpected expenses.

However, payday lenders have come under scrutiny regarding how justly they treat their borrowers. As such, payday lending and similar types of loans are completely illegal in some states. We’ve broken down some of the main legislation for payday loans in the US.

Are Payday Loans Legal in My State?

Every state has its own laws surrounding payday lending, dependent on how their customer protection office handles high-risk borrowing. If you are unsure about whether payday lending is legal in your state, you should find the information you need about payday lending in your state in this guide.

In Which States are Payday Loans Legal?

Currently, 37 states authorise payday lending, making it legal to take out a payday loan. These states include: Alabama, Colorado, California, Illinois, Indiana, Iowa, Kentucky, Louisiana, Ohio, Tennessee, and Texas.

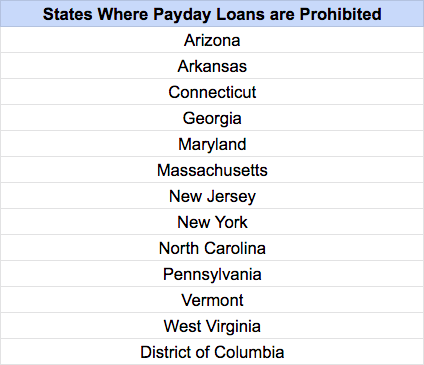

In Which States are Payday Loans Illegal?

According to the National Conference of State Legislatures, there are currently 13 states which prohibit payday lending, making it illegal to take out a payday loan. These states are: Arizona, Arkansas, Connecticut, Georgia, Maryland, Massachusetts, New Jersey, New York, North Carolina, Pennsylvania, Vermont, West Virginia, and the District of Columbia.

Which States Have Payday Loan Caps?

Payday Loan interest rates caps have been set in many US states. For instance, in Colorado, Montana, New Hampshire and South Dakota the annual interest rate limit on payday loans is 36%, and any additional fees have been banned. In addition to this, federal law also dictates that fees are capped at 36% for all members of the military, regardless of their state.

Recently, an increasing number of states have taken action to pass legislation or increase restrictions surrounding payday lending and payday loans. As of the 2020 legislative session, there are 21 states which have pending legislation surrounding payday lending and payday lending alternatives. At the beginning of November 2020, the citizens of Nebraska voted to enact a new cap on payday loan costs. In Utah, the legislation that was enacted dealt with operational requirements, registration requirements, and reporting requirements.

Virginia is one of the states that is passing tighter payday loan legislation. The Virginian enactment replaced references to payday loans with the term “short-term loans.” The enactment also capped the interest and fees for a short-term loan to an annual rate of 36%, plus a maintenance fee. It also increased the maximum value of these loans to $2,500 from $500, and implemented a set minimum duration of four months, subject to exceptions, and a maximum duration of 24 months.

See examples of price caps in US states below:

| State | Max Interest Rate |

| Alabama | 456% |

| Alaska | 435% |

| California | 460% |

| Colorado | 36% |

| Delaware | 391% |

| Florida | 304% |

| Hawaii | 460% |

| Idaho | 652% |

| Illinois | 36% |

| Indiana | 382% |

| Iowa | 433% |

| Kansas | 391% |

| Kentucky | 469% |

| Louisiana | 478% |

| Michigan | 370% |

| Minnesota | 390% |

| Mississippi | 521% |

| Missouri | 527% |

| Montana | 36% |

| Nebraska | 36% |

| Nevada | 652% |

| New Hampshire | 36% |

| North Dakota | 520% |

| Ohio | 138% |

| Oklahoma | 207% |

| Oregon | 156% |

| Rhode Island | 261% |

| South Carolina | 391% |

| South Dakota | 36% |

| Tennessee | 460% |

| Texas | 664% |

| Washington | 390% |

How Can I Tell if a Payday Lender is Legally Licensed in My State?

You should always check whether a payday lender is legally licensed before taking out a payday loan. Payday lenders or online payday loans companies should have a state-issued licence. These licenses should be visible either at the store-front, or on the website.

If you are unable to see the license, you should ask to see it. If the lender is licensed, they will be able to show you their state-issued license. If you are still unsure or have doubts, you can verify the license with your financial regulations office or state attorney.

I’m Being Advertised Payday Loans in a State Where Payday Loans Are Illegal, What Should I Do?

Seeing an advertisement for a product that is illegal should be an immediate warning, and the same applies for payday loans. Some predatory lenders actually work around legislation in order to offer clients unlicensed and illegal payday loans. Here, the client will likely become trapped in a cycle of debt through interest rates that are far higher than the legal limit.

If you feel as though you may have been a victim of a payday loan scam, contact the police and your state attorney immediately. They will provide you with information about where to go from here.

Was this article helpful?

Daniel Tannenbaum has worked in the payday loan and consumer credit space for over 15 years across the USA. His posts share useful insights into the financial world, money advice and opinions.