Yes, it is possible to cancel a payday loan at any time. Terms and conditions of a payday loan online agreement usually state that you have the option to terminate your loan at any point, whether that be on the same day your loan was taken out or a week or two later. Just be aware that you could face interest fees for any days that your loan was open or early cancellation charges.

Why Might I Want To Cancel A Payday Loan?

You may want to terminate your payday loan if:

- You wish to clear your loan early and no longer need the money.

- You have got access to funds elsewhere such as from family and friends or from other loans you applied for on the day you need cash fast.

- You cannot afford to pay the mounting interest so decide to pay it off early to maybe only pay 7 days worth of interest instead of 21.

- You find a better suited alternative such as a low interest credit card or a credit union.

How Do I Cancel A Payday Loan?

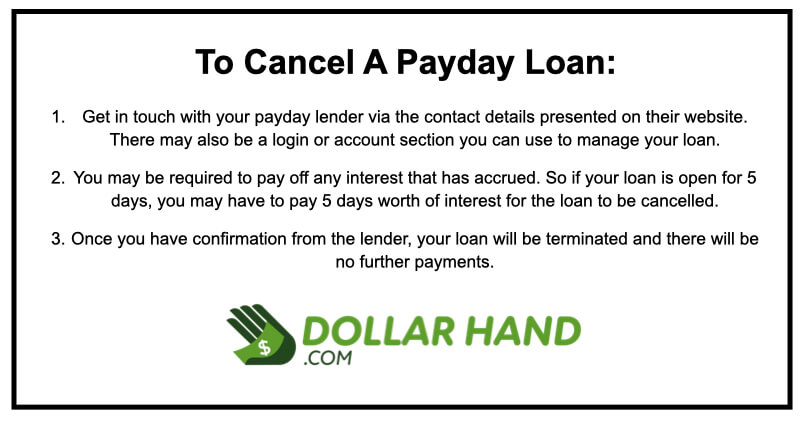

Get in touch with your lender as soon as you realize you want to cancel your payday loan. Either call, email or write to your lender to arrange doing so. Typically, you will have to pay off your loan in full or however much interest has accrued up until this point to meet the terms of canceling your payday loan.

Some lenders however may offer a cooling period whereby you have 24 or 48 hours to terminate your loan with no fees or interest accrued. Check the terms and conditions that would have been presented to you during the application and approval process to check if this applies to your loan agreement.

Will a Payday Lender Still Charge Me Interest if I Cancel After 1, 3 or 5 Days?

It is possible that a lender will still charge you interest even if you want to cancel your payday loan after just a few days. From the minute the loan is approved and sent to your bank account, you will usually start to accrue interest each day of around 1%. If you were to borrow a $800 loan, that would be a daily interest of around $8.

There are exceptions however as some lenders offer a cooling period of 24 or 48 hours where you can return and cancel the loan with no fees applied. Check the terms and conditions of your loan agreement to see if you are eligible for this.

Whilst it may seem unfair for a lender to charge you fees if your loan is only open for a few days, it can be justified as processing, underwriting and credit checking your loan application will cost the lender a few dollars. So the small payment can help them to recover their costs.

Will Canceling A Payday Loan Have Any Impact On My Credit Score?

As long as the loan has been repaid and is not overdue or in arrears, then there will be no negative effect on your credit score. It should remain the same as if you continued your loan for the full course.

Can I Get My Bank to Stop Payments to a Payday Loans Company?

Yes. If you want to stop payday loan repayments from coming out of your bank account, you can contact your bank to stop payments from being automatically taken out.

When your loan is approved, ACH authorisation occurs and collects payments from your account each month – and you can call your bank to stop these payments (source). However, if your loan is still live, then you may be liable for any interest accrued and any outstanding repayments. So whilst you can ask your bank to cancel payments to a payday lender, you must also contact the lender to arrange closing your account.

Was this article helpful?

Justine is a full-time writer with lots of expertise and a wealth of experience in the financial world. In particular, she specializes in household income and consumer finance across the United States. Follow her articles for useful advice and top tips, guides on how to save money and lots more.